While this post may seem out-of-touch with today’s real estate market in NJ, it’s my contention that multiple economic headwinds from 2016 and beyond will lead to structural changes in the economies of the northeast which will in turn cause pretty severe price declines and adjustments for NJ (and many northeast regions) real estate property values (residential and commercial). / and other big cities in the northeast; read on a bit as I make my case.

First off disregard all the FUD (Fear, uncertainty and doubt) that the NAR and all the supporting industries (developers, bankers, mortgage brokers, lenders, furniture salespeople etc.), keep talking about “how there’s never been a better time to buy a home?”, how buying now and not missing out on appreciating housing prices, blah, blah… and how housing prices have been going up, reaching near pre-2008 levels.. all these folks have a keen interest in creating the illusion of a booming housing market and maintaining the illusion of scarcity.. Don’t take my word for it watch this clear insightful description of how lenders and servicers , artificially manipulated the foreclosure market to prop up and increase housing costs, but this is just a minor issue the larger issues are detailed below.

Another reputable source economist Robert Shiller (of the Case-Shiller economic indicator) “wouldn’t be at all surprised” if U.S. house prices start to fall https://bloom.bg/2zWqMSp .

Here’s a cautionary tale.. from George Gammon..

As of 2017 you can already begin to see the pricing declines play out,take a look at this chart posted by Patch.com which visually highlights price declines by county. The Chart below was published on an article about housing value On NJ Patch.com ,the reasons I mention below will only increase the declines, before finally bottoming out..

But the major reasons going forward are more structural, there four immutable reasons why I anticipate this “crash” (crash is my euphemism for severe pricing deflation) will happen, its only a question of when.

Reason #1: Demographics , Property taxes and high cost of living , aging baby boomers retiring and leaving expensive states

Goodbye NJ , we’re cashing out and moving to NC, FL, AZ, TX (insert your southern sate here) to live like kings.

If you live in NJ (or much of the northeast such as NY, Connecticut, Boston) , you may notice that a large percentage of the homeowners are likely folks 40+ and many of those are retirees, which makes sense…

Those that are retirees (> 65+ ) are typically living on fixed incomes (social security, pensions, 401k or IRA distributions) , and that means that because of the heavy real estate tax burden (property tax rates well over 2.5% in many NJ counties) many are economically incentivized to sell and downsize to a more affordable area. Others may choose to relocate, downsize and stay local, others may, due to health concerns move in with family or long term care facilities and finally some may pass on leaving properties to their heirs or the banks.

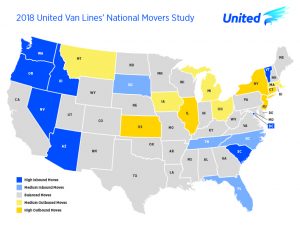

This trend is already happening, Forbes reported as recently as (Sept. 2019) ” Tri-state residents Are Leaving …In Droves…“, and happening in a very big way. According to USA Today Retirees are fleeing these three states — and choosing these locations instead , guess which states topped the exodus list? Yep According to United Van Lines survey , in 2018 , Almost 67% of all New Jersey moves were outbound last year . So little by little those folks that have built up equity are leaving.. The TOP three states people are exiting from are NJ, Maine and CT. And according to the data The largest age group of people who left NY, NJ were between the ages of 55 and 64, followed by those 65 and older.

At it’s core it’s simple math and wealth preservation. Many of these retirees have seen equity in their homes rise 50%-600% over the last 20 to 40 years . For example a typical house in Northern NJ they purchased in the 1980’s for $100k+ today is worth $500K-$1.2Mln or more (depending on location) , so those folks are looking to cash out the equity in their homes and move to cheaper cost of living states with better weather and retirement communities (generally southern states). Add to that the newly minted 2017 US Tax reform signed at the end of 2017; will limit deductions on state taxes and real estate deductions to $10k, which hits NJ/NY homeowners hardest, yet another incentive NJ retirees to sell now.

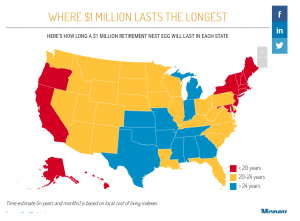

Retirees and those living in expensive states, don’t need statistics like Money’s Recent How Long does $1 mln in retirement savings last in each state, to know the obvious that living in coastal states is expensive (those in red) you will exhaust your $1,000,000 nest egg retirement savings in less than 20 years..

USA Demographic Flows 2015-2017 , Regardless of how you slice it, there is an on going exodus from the high cost states to more reasonably priced ones, especially for folks with fixed incomes — retirees. And as we know those folks are the baby boomers , that means a large chunk of the demographic curve will be migrating away from high-cost states, there’ s nothing that will change this..

And it’s not only residents thinking of leaving, there’s also a slow on-going exodus of large corporations re-locating to more cost effective states. Whether its Mercedes relocating to Atlanta or General Mills closing their NJ plant, its all due to the high cost of doing business located in NJ, high wages are the result of high property taxes and cost of living… there are many other , particularly southern states are offering more attractive opportunities.

Reason #2: Millennial’s low incomes leads to slow family formation

Traditionally in the past, when younger folks reached their mid to late twenties or early thirties, they would begin looking at settling down, and the housing cycle would continue. The younger generation would look at starter homes and perhaps buy from retirees looking to downsize or move on..

But if you look at the current generation in that demographic (18-30) you quickly see a couple of troubling indicators. The first one is those millennial’s that went college and beyond , are now burdened with high student debt, there are plenty of stories about millennial’s student debt everywhere. So money that may have gone to starter homes, now goes mostly to servicing their debt.

Second those that are working (and went to college) are typically in jobs or roles that pay well below what their high-priced educations supposedly prepared them for. Many work in retail, entertainment, commission only sales, driving for Uber or other part-time gig work. Many of these positions pay very low wages for this region of the country, certainly not enough for home ownership, on a single wage. Here’s a recent article highlighting the issue of millennial under employment (1/2019 source Bloomberg)

A recently published report by Business Insider breaks down just how little millennials earn state by state today. In NY the study notes:

“They earned less than millennial men in all but one state — New York. Between 2011 and 2013, young women in the Big Apple made $38,319, while men earned $37,542.”

Of course there are always some percentage of millennial’s that are doing well and moving up the economic ladder but that is a much smaller percentage than in past generations.

In summary millennial’s simply don’t have the buying power to afford the homes and property taxes that the retirees are running away from, and this is not likely to improve, in fact its likely to worsen as per the next reason.

Reason #3: Increasing Income inequality and the coming automation of middle-class jobs.

At the heart of this issue is the ever increasing economic inequality. The American dream of going to school and getting a good high paying job,buying a home is likely in its waning days (at least on the coasts) . Primarily because we are now entering an era where increases in automation , are leading from the information age, to the age of capital. That is, if you have enough money to invest (or own business or properties) then you can even make more money. This is all thanks to advances in technology, increased market efficiencies and globalization (foreign workers , cheaper labor) , which make those with capital and deep pockets able to even more maximize their investments.

But the really large disruption going forward isn’t globalization; it’s automation, there is a coming wave of automated systems that will do away with many good paying white-collar positions. These were typically well-paying middle-class jobs that many of the millennial’s went to college for. There’s a steady drumbeat of leading figures in Technology that already see this coming, here’ just one of many, examples.. “A.I. will replace half of all jobs in the next decade, says widely followed technologist”

Just look at industries such as finance, accounting, engineering, marketing, planning, are doing with automation technologies. Many of those jobs would traditionally offer a foothold to a solid middle-class lifestyle but the quantity of those jobs will be reduced. Not sure if your job is one of them? here’s a litmus test, does your work primarily involve sitting in front of computer and making “educated” decisions or updating data? Answered yes? then yep, it will surely be eliminated or drastically reduced in the next 10 years. Today there are deep-learning systems ( a form of machine learning , AI:Artificial Intelligence) that can often accomplish what formerly educated folks did at a fraction of the cost, and more effectively (aka better than people) and companies are keen to use them for cost savings. About the only jobs that will be spared are those that require lots of physical dexterity (think plumbers, carpenters, home health worker ) or lots of human interpersonal connection (think nursing, teaching, arts).

Even low-skilled fast food workers are not immune, there are companies already working on fast-food automation systems, to replace those pesky $15/hr workers. There are similar stories popping up all over the place, here’s a Forbes piece, that is reporting the folks at the 2016 Davos economic summit are saying automation will cost 5 million jobs by 2020.

In fact is this trend will accelerate the further into the future we go, eventually even blue collar jobs such as truck, bus and tax drivers will be eliminated or reduced, but because of legal and technical constraints those are not likely happen for another 20 years.

What all this means is that there will be a greater gulf in income inequality between the technology and industry elites who own the automation technology, and the remaining working class folks, this is mostly due to the way our government and business works, former labor secretary Robert Reich goes into detail here, on the vicious cycle of wealth and power.

Eventually most struggling middle-class wannabees may be reduced to an amalgam of sharing-economy type jobs (think of having 2-3 type Uber jobs (ironically, even Uber jobs are going-away some day too) with no job security or benefits. All this means less savings and disposable income for younger generations to make big purchases, such as….. you guessed it housing.

Bonus Reason : NJ specific – high real estate taxes and municipal pension obligations

The fourth reason is really more related specifically to NJ but may also apply to neighboring high tax states like NY and CT . NJ in particular has the notorious distinction of the highest real estate tax rate in the country.. this rate which is really the result of two major state issues.

First NJ simply has too many townships with their own police, fire and schools, unlike other states where municipal resources are aggregated at the county (parish ) level. NJ every small town wants to be a kingdom onto itself, so naturally, the property owners must foot the bill, for emergency services, teachers, etc. There have been attempts in the past by state and even municipal governments to consolidate, but generally consolidation requires a reduction (which is the whole point of consolidation) in municipal employees and these attempts have always faced a backlash from whatever group is potentially losing out.

Second its, not just too many little kingdoms, its all the generous municipal pension obligations promised to teachers, fire, police and other municipal employees , which keeps the financial burden going , long after those folks stopped working full time. These promises made by former elected officials that once courted powerful labor unions for their election campaigns, have left this legacy for future generations, kicking the proverbial can down the road. You can read all about that here about the on-going pension crisis. Eventually this will cause many towns and cities to seek bankrupt protection , similar to what happened in Detroit,for many of the same reasons. In fact a recent Forbes article shows that many of these state pension funds are more broke than ever.’

You also have a changing interest rate environment in 2018-2019 with rates going up, which will certainly affect new buyers.

But I see condo’s and new developments all over the place in NJ, and my friends are all buying 2nd homes to flip? .. just like the game musical chairs…

Yes, there are many new developments in urban areas of NJ especially those nearest to NYC or near commuting centers that lead to NYC, where older properties are being reclaimed and converted to residential developments . Also there are many homes being rehabbed and paid for in cash by savvy real estate investors to flip. This post is not about them, since those developers have relatively short time horizons, they are looking at 3,6,12 or 18 month time horizons.

Most developers and real estate investors know that timing is critical and that the key thing for them is to build, renovate or otherwise turn their investment into a cash producing investment whether through rental income or profit from flipping as quickly as possible. Anyone who has ever flipped a home or has done real estate investing , knows that timing is the biggest factor in determining whether it will be profitable or not, wait too long and market conditions ( interest rates, economic growth, neighborhood reputation, credit standards) may shift, squeezing whatever profit you were hoping to make.

In a sense the current market for those folks is like musical chairs, while developments and restorations go on, and the market still has willing buyers that qualify for bloated mortgages all is fine, but when the economic growth music stops playing, then we’ll find out who has a place to sit down. Those investors that come late to the game , when the inevitable market decline happens will get burned.

When will the “crash”happen?

I put “crash” in quotes, because it will be different than 2008, in that it will not likely happen in one year (baring some big external economic shock), rather it will start slowly then accelerate. Obviously it’s impossible to predict the exact moment, but based on the above reasons, when we hit a nexus , when a large number of retiree homeowners start leaving the state, continued economic apathy of younger homeowners and buyers, coupled with ever-increasing tax burden on the smaller and smaller pool of tax-paying homeowners, this will result in a tipping point.

My prediction is some where towards the end of 2019 / mid 2020 ,basically they next time the US economy has a a significant downward swing, this will likely be the start of real estate price correction.

The next real estate “crash” may be even more global as price valuations have been going up in many global markets. In short, much of the world is over-leveraged, too much debt which is kind of how we got into the last mess…

Likely the first definitive signs this “crash” is starting will be Detroit like bankruptcy-protection measures requests by towns and cities in NJ. Those municipalities that can no longer support their municipal obligations because of a reduced tax base, will cause a cascading effect and more and more towns will seek protection, more and more homeowners will seek to leave, request tax re-assessment, look to sell and this will manifest itself in a spiral of rapidly decreasing housing prices.

It will all work out in the end.. but at a much lower price point

Because of the market forces eventually over time housing prices in NJ will stabilize, of course at much much lower levels. So a house that might cost $300k , $400k today after this economic adjustment it will probably go for $150k, or$200k in the next 10-15 years.

I exclude exclusive locations like NYC, Manhattan , Boston, Washington DC or other city centers from this prediction as those places may always have exorbitant costs because of their economic muscle and geographic concentration of wealthy populations (virtually all homeowners in city centers are millionaires and multi-millionaires already) , this does not apply to them, yet..

The simple fact is mathematically its, not sustainable over the long term (15-20 years), when you combine high home costs with increasing real estate tax burden , with reduced number of high income jobs, you have a perfect storm for a large deflation in property values.

But I suspect if you’re a NJ homeowner reading this you may be incredulous that the home you paid so much for will be worth so little, after all don’t housing prices always go up, and never down? I don’t think so, even accounting for inflation …for the economic realities I noted above., no matter how much every person in the real estate industry wants to convince you otherwise, the coming reality is almost unavoidable… plan accordingly.

I think this article is a bunch of bunk, I work in real estate and they are building all sorts of developments in NJ with many of them already sold. This is just some more fear mongering form somebody who’s probably shorting the real estate market.

Yep, all my peers are out of here.. yep pretty much agree with everything in this article, but its actually even worse.

I was at a recent municipal hearings recently and a fellow homeowner who works in banking told me the trend that’s developing is banks are about to unload a large inventory of forclosed housing crisis homes, that are still on their books. Because these banks are taking a bath paying the property taxes and are happy about selling deep discounted properties to clear their balance sheets..

Ohh yeah it’s gonna get ugly in NJ

Its not wonder look here: http://patch.com/new-jersey/hasbrouckheights/you-wont-believe-how-much-nj-school-districts-pay-100-people-who-dont-work

I came across this blog after seeing all the for sale signs going up.. I live in Ridgewood and it’s like every other house is for sale…

Yep, I think an interesting chart would be to see for_sale vs. home owner age, I think you’ll see in towns with older homeowners will likely have more for sale signs, Ridge wood strikes me as an older community.

This is bs, all gloom and doom, NJ will always be a strong demand for properties here, there’s new construction all over the place..

Interesting points.

I’m a 27 year old millennial looking to buy my first property in NJ (near PATH or Tunnels) around the $400-500k mark for 2-3 bed/1000+ sqft.

Seeing quite a lot of old single-family townhouses being rebuilt into luxury condos with 2-3x 2/3 bed units on the property selling for 400-500k each. So it seems the old former retiree 2000sqft homes that are selling for $500-600k are being flipped for $1m+ across multiple units.

– What would you say this predicts in terms of the bubble?

Also, would you say Jersey & Union City have similar ‘economic muscle’ as NYC?

Thanks for anyone and everyone’s input!

I agree with you, there are lots of older properties being flipped near NJ transit hubs, in JC , UC etc. As I mention in the article if you’re looking to be a real estate investor and are planning to get in , refurbish and get out within 18 months you may be able to turn a profit. However if you’re looking to own for the long term (10 years+) , then you need to really consider the macro changes in the ecnonomies of NY and NJ. Remember NYC is the engine that drives the entire region. What happens when say 10/15% of those high paying office jobs in NYC become automated? I don’t have a crystal ball with 100% accuracy, but the reasons discussed in the post are pretty compelling.

I agree with the other posters, it’s hard to guess when the housing market will crater next, plus unlike the stock market (which is most certainly heading for a major cratering within the next 24 months) , housing markets are much more regional and are not all affected the same way even if another 2007-2008 economic shock occurs.

I think your mostly in danger if you are considering and expensive property in the Northeast. This blog post does a good job of explaining why.

In a nutshell expensive coastal areas with high real estate taxes and aging retirees are most susceptible to severe housing deflation. If your planning on buying a $500+k in northern NJ or Westchester county, buy cautiously or wait it out.

Housing is in some areas (remember it’s very regional) is very fickle and everything is fine till it isn’t. Remember the last crash had housing prices collapse in some places by as much as 80% (Las Vegas, Detroit etc..) within a 12-18 month period… So don’t be to quick to dismiss you prepper father.

My parents bought their first home in 79 or 80 for 86k and sold it about 2 yrs ago for a 500% increase. There is no way I could ever sell my home which I built for around 500k at that much of a profit in my lifetime. The baby boomers are the last “lucky generation”. The following generations will be hard pressed to make it to retirement. This article is sad but true. In my opinion here in NJ the biggest problem is gov pensions and payroll.

I hate to agree having grown up in NJ, but the writing is on the wall. Short of some incredible change in municipal and state obligations, I see only a few scenarios and they all look bleak.

just read the article…Why NJ / northeast real estate housing values will crash in coming years I thought it was brilliant could you please do a follow up…I have a friend who is actually a pretty famous financial guy & he recently told me we’re going to have a mega crash in real estate…we’re coming off all time low interest rates for every 1% the rates rise the house has to come down 10% in value because the monthly payment goes up etc also another factor he says is most states especially NJ have insane levels of pension debt NJ with a Democrat Governor & Democrat State House will raise property taxes thru the roof as the pensions start to collapse in 2019…he thinks we could see especially in the coastal towns where prices are really high a 50%-70% price decline before it turns around…I know that seems crazy but this guy has been right so many times in the past it’s hard to argue with him…a follow up to your tremendous article would be much appreciated

Funny 3 of my retired relatives cancelled their annual events (July 4 bbq, Thanksgiving) because their places are up for sale and they hope to be out of NJ by then…

I think this article is a bunch of bunk, I work in real estate and they are building all sorts of developments in NJ with many of them already sold. This is just some more fear mongering form somebody who’s probably shorting the real estate market.

I don’t know seems like the residential market factors mentioned above are pretty on point.

I personally know my uncle is leaving for Florida, and quite a few for sale signs in his neighborhood..

I also see a.lot luxury apartment developments,.but not really sure how those will playout